China Sporting Goods Industry Development Report (2023)

This report provides a comprehensive research and analytical interpretation of the operation of the sporting goods industry in 2023, revealing the current operating status of the sporting goods industry as well as the new characteristics and trends from multiple perspectives. The report is divided into eleven parts, which analyze the definition of the sporting goods industry, development environment, overall operation, development characteristics, production operations, market demand, import and export, industrial investment and financing, etc. The report also completed and released the sporting goods industry prosperity index through a prosperity survey, enhancing the report's predictability and guidance on industry development trends.

1. Definition of Sporting Goods Industry

The "sporting goods industry" mentioned in the report refers specifically to the collection of enterprises with the production and manufacturing of sporting goods as the main economic activity. According to Classification of The Statistical Classification of Sports Industry (2019), it includes the sports goods and equipment manufacturing (091), Sports goods related materials manufacturing (093), and sporting goods-related supplies and equipment manufacturing (094) under the three sub-categories of Sporting Goods industries, excluding sporting goods sales, leasing and trade agents as the main business of the enterprise.

2. Development Environment of the Sporting Goods Industry

Policy environment. The outline of the "14th Five-Year Plan" proposes to promote the optimization and upgrading of the manufacturing industry to "high-end, intelligent, green and service-oriented" which determines the medium and long-term development path of China's manufacturing industry to promote its development and transformation and upgrading. In 2023, General Administration of Sports of China, National Development and Reform Commission and other departments issued a series of policy documents. The policy objectives are mainly focused on promoting national fitness, building China into a global sports power and developing the sports industry. At present, it is still in the stage of policy intensive release, and more policies will be introduced in the future to promote the development of the sports goods industry.

Economic environment. In 2023, The global economy is set for a weak recovery from the shocks of Covid-19, and the decline of consumption capacity, China 's total retail sales of social consumer goods, investment in fixed assets, per capita disposable income of residents and other macroeconomic indicators ran well. Foreign trade was generally stable, and the overall economy continued to rebound and improve.

Social environment. In the post-epidemic era, residents’ awareness of physical exercise and fitness has increased, and their demand for sporting goods has increased. At present, there is still a structural shortage in the supply of sports venues and facilities in China. Changes in the demographic structure are triggering changes in the demand structure. Under the two-way squeeze of the rapid increase in the elderly population and the decline in the birth population, the sporting goods industry is facing the requirements of medium- and long-term structural adjustment.

In all, the development environment and related policies have clarified the following points for the current and future development of the sporting goods industry: First, Strategic positioning, continue to implement the manufacturing power strategy, promote high-quality development of the manufacturing industry, and maintain the basic stability of the proportion of the manufacturing industry; second, development philosophy, adhere to China’s Policy Strategies for Green Low Carbon Development. and promote energy-saving and carbon-reducing technological transformation; third, development direction, we need to break the low-end lock-in with innovation-driven and move towards the mid to high end of the value chain. fourth, in the development model, the manufacturing industry and the service industry are integrated and developed to cultivate new business formats and new models. in terms of market demand, the policy's derivative effect on the market demand for sports goods is still continuing and expanding and optimizing national fitness venues and facilities is the main theme of the future; sixth, in terms of service objects, we should strengthen the construction of sports facilities in counties, townships and villages and strengthen "Aging-friendly" and "Child-friendly" fitness facilities. Seventh, technology application, intelligent manufacturing should be promoted through the integration and development of 'Internet+' and the empowerment of digital technology.

3.Overall Operation of Sporting Goods Industry

3.1 Scale and Growth Rate of Sporting Goods Industry

According to data released by China National Bureau of Statistics, the total output of the sporting goods manufacturing industry in 2022 was 1425.9 billion yuan, an increase of 5.1% year-on-year; the added value was 368.6 billion yuan, an increase of 7.3% over the previous year. The total output of sporting goods manufacturing industry accounts for 43.2% of the total output of the sports industry, which is basically the same as 43.5% in 2021.

Figure1 Total output scale and growth rate of sporting goods manufacturing industry

According to the operation of listed sporting goods companies and member companies surveyed, 40 listed sporting goods companies have maintained a year-on-year growth rate of 6.65% in the first half of 2023, under the base effect of rapid growth in 2021 and 2022. According to the data of 213 member companies, there was a slight decline of 3.10% in the total output in 2023. In general, the output scale of the sporting goods industry in 2023 has slowed down to some degree compared with the growth rate in 2022. However, considering the positive factors of accelerated growth rate of the overall operation of the national economy in 2023, the output scale of the sporting goods industry in 2023 was still expected to maintain a high growth rate. From the perspective of the change in the number of sporting goods enterprises, in 2023, the number of newly established sporting goods companies (including self-employed individuals) reached 75,000, which just hit an all-time record high. It reflects that social investment in the sporting goods industry has once again entered an active period and production capacity has been further expanded.

3.2 Number of Sporting Goods Enterprises

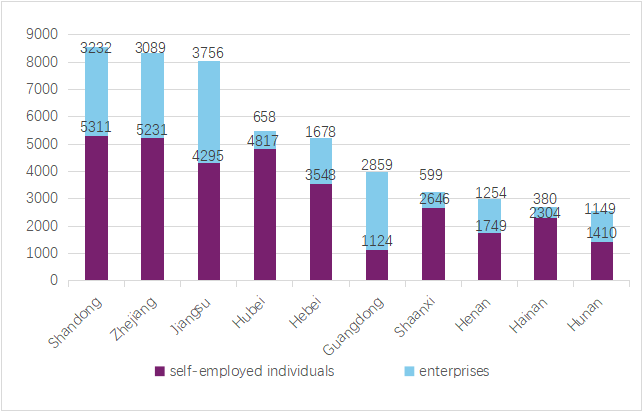

There are a total of 187,213 sporting goods manufacturers (including various enterprises and self-employed individuals) in China by the end of 2023, and a total of 63,595 sporting goods manufacturers were in operation. Among them, there were 27,853 enterprises of various types, accounting for 43.80%, and 35,742 self-employed individuals, accounting for 56.20%. In terms of the number of sporting goods manufacturers, Shandong ranked first with 8,543, followed by Zhejiang with 8,320 and Jiangsu with 8,051. The number of sporting goods manufacturers in the first five provinces and regions accounts for 56.00%, reflecting the regional characteristics of the distribution of sports goods manufacturers in China, as shown in Figure 2.

Figure 2 Number of sporting goods manufacturers in operation in China 2023, by region

From the perspective of newly established enterprises, during the Covid-19 epidemic, the number of newly established enterprises and self-employed individuals declined gradually, but there was a significant increase in 2023, with the number of newly established enterprises reaching 75,147, exceeding the 74,676 in 2019 and hitting a record high. It reflects that the sporting goods industry entered an active period in 2023, and social capital was generally optimistic about this field, and production capacity is gradually expanding.

3.3 Regional Distribution of Sporting Goods Enterprises

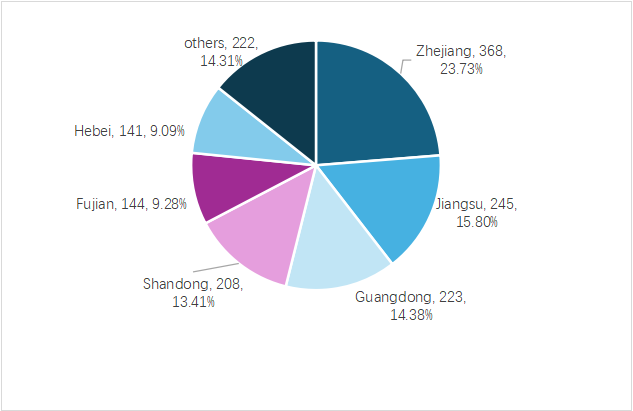

The agglomeration characteristics of the sports goods manufacturing industry are distinct. Among the 1551 exhibitors of the 2023 China International Sporting Goods Expo, Zhejiang had 368 exhibitors, accounting for 24 % of the total number of exhibitors, followed by Jiangsu, Guangdong, Shandong, Fujian and Hebei. The top six provinces and regions accounted for 85.69% of the total number of all exhibitors, with high regional concentration (see Table 1 and Figure 3). The regional distribution of the members of the China Sporting Goods Federation also shows the characteristics of industrial agglomeration. Zhejiang, Guangdong, Shandong, Jiangsu and Hebei provinces have significantly more members than other regions, and the number of members in the five provinces accounts for 69.91 % of the total number of members.

Table 1 Ranking of the Number of Exhibitors in Sub-industry by Region

|

Ranking |

Fitness equipment |

Sports venues and facilities, venue construction and Artificial Grass |

Ball games, tennis& badminton and combat Sports equipment |

Sports and leisure products |

||||

|

1 |

Zhejiang |

207 |

Guangdong |

70 |

Zhejiang |

59 |

Zhejiang |

59 |

|

2 |

Jiangsu |

139 |

Hebei |

59 |

Jiangsu |

37 |

Guangdong |

47 |

|

3 |

Shandong |

138 |

Jiangsu |

48 |

Guangdong |

30 |

Fujian |

26 |

|

4 |

Fujian |

62 |

Shandong |

28 |

Shandong |

28 |

Jiangsu |

9 |

|

5 |

Guangdong |

51 |

Beijing |

24 |

Hebei |

24 |

Shandong |

6 |

Figure 3 Number and Proportion of exhibitors at exhibitions in China 2023, by region

4. Characteristics and issues of the development of the sporting goods industry

4.1 Characteristics of the development of the sporting goods industry

Firstly, Service-orient Transformation in Manufacturing Accelerates Integration. More and more sporting goods companies are undergoing a transition from traditional manufacturing to service-oriented manufacturing. This transformation is leading to the formation of an integrated product and service system. This shift is moving away from a product-centric approach to a user-centric, enabling the creation of products and services that better meet the diverse and personalized needs of consumers.

Secondly, Artificial Intelligence’s Use and Rapid Growth. Fitness equipment is undergoing a transformation towards greater intelligence, with the popularity of intelligent products increasing significantly. Intelligent fitness paths, intelligent home fitness equipment, and other similar products have become mainstream fitness equipment. From skipping ropes and resistance bands to excise pedals, Bike Trainer, rowing machines, almost all treadmill products can be interconnected with mobile phones, demonstrating the extensive applicability of digital technology in sports and fitness.

Thirdly, the outdoor equipment industry has entered a period of rapid growth. Outdoor sports have continued to recover and develop in China since the beginning of 2022. Outdoor sports such as winter sports, cross-country camping, road running and cycling, mountain climbing and rock climbing have all shown positive development trends especially in 2023. Which resulted in a surge in outdoor sports participation. and led to a surge in market demand for various types of outdoor equipment. From the positioning of the recently released relevant document "Building outdoor sports into a dominant industry for national fitness", which will result in outdoor sports becoming a core area of the sports industry in the future.

Fourthly, leading companies develop in multiple categories and multi-channels. Many leading companies have extended the development of multi-category products and services, utilizing Omni- channel solutions to facilitate seamless interaction between customers and brands on different platforms and channels. This has resulted in improvements to marketing and customer acquisition, as well as the establishment of an Omni-channel sales model, whereby online and offline sales channels are integrated in a deep manner.

Fifthly, the transformation of green manufacturing is under pressure. Under the constraints of China’s ‘double carbon’ policy, and the concept of the global green economy, circular economy and low-carbon economy have been widely recognized and implemented, Consequently, the sporting goods industry, which has relied on traditional manufacturing, is now faced with the challenge of transitioning to green manufacturing. However, many enterprises, particularly small and medium-sized enterprises, face significant obstacles in terms of production costs, talent, and technology, which make real obstacle to the green transition.

Sixthly, the emergence of new demands, new scenarios, and new modes has led to the development of new demands. The development trend of "Aging-friendly" and "Child-friendly" sports products has become increasingly evident. A number of new sports scenes and new models with a strong sense of experience and technology have emerged, placing new demands on the sporting goods industry.

4.2 Issues of the development of sporting goods industry

Firstly, the growth rate of sporting goods market demand has slowed down. China's domestic effective demand is insufficient, China's fiscal revenues grew at a slower annual pace, signalling broadening economic pressure. People are experiencing "live a tight life”. Consequently, general public services, education, and other areas of financial expenditure will inevitably be affected. The growth rate of government investment in sports facilities, the construction of school facilities, and government sports procurement will slow down or even decline.

Secondly, the product structure requires enhancement and optimization. The sporting goods industry as a whole is still predominantly focused on low-end products, with limited development and a prevalence of low-quality, low-technology, and homogenized products. There is a notable absence of well-known brands with international influence, and a lack of high-value-added products.

Thirdly, the low-end market remains characterized by disordered competition. Products offered at low prices and of inferior quality rely on aggressive pricing to secure market share, which has the effect of undermining the logic of market competition based on quality. The result is that the phenomenon of “bad money driving out good” whith has a significant impact on the long-term development of the industry.

Fourthly, the pressure on labor costs continues to increase. The rise in labor prices has significantly increased the burden on enterprises and reduced product competitiveness. As a result of the lower labor costs in Vietnam, Indonesia, India, and other countries, China's sports footwear and apparel and other labor-intensive industries have been affected. Many international brands are shifting their production capacity from China to Southeast Asia and South Asia countries, which is affecting the development of China's sporting goods manufacturing industry and international market competition.

Fifthly, the prices of raw materials are subject to significant fluctuations. Companies are still facing the risk of sharp fluctuations in raw material prices, as it grapples with tight geopolitical tension and international commodity price fluctuations. Concurrently, with the promotion of national supply-side reform and the implementation of the national ecological civilization strategy, environmental policies have become increasingly stringent in response to environmental challenges. Which has resulted in a continued rise in the prices of chemical raw materials, steel, packaging materials, and other raw materials, thereby increasing the challenge of enterprise cost control.

5. Production and Operation in the Sporting Goods Industry

The sporting goods industry demonstrated consistent performance and resilience in the face of challenges in 2023. This report provides a comprehensive analysis of the production and operations of 40 listed companies in the sporting goods industry and 213 member companies of the China Sporting Goods Federation.

5.1 Changes in the scale of production in the sporting goods industry

5.1.1 Production scale of listed sporting goods companies

The listed companies in the sporting goods industry are demonstrating robust economic resilience, with a continued growth rate of 6.65% in the first half of 2023. This growth is a continuation of the substantial revenue growth in 2021 and 2022. However, 19 companies' revenue fell in the first half of 2023 compared with the same period last year, accounting for 47.50%. Despite all the optimism, many companies are facing the pressure of declining revenue.

An analysis of the changes in operating income of listed companies in sports footwear and apparel, fitness equipment, and outdoor products found that all three industries have experienced substantial growth in 2021, especially the outdoor products industry, which has increased by 53.17% and continue to grow in 2022. Maintaining a growth rate of 7.52%, there was a sharp decline of 25.64% in 2023. The fitness equipment industry had grown by 19.42% in 2021. However, there was a sharp decline of 24.83% and 26.00% in 2022 and 2023 respectively. The sports footwear and apparel industry has maintained a steady trend and revenue growth trend. The growth rates in the past three years have reached 18.26%, 11.52%, and 14.42% respectively (see Table 2).

Table 2 The revenue growth of listed companies in different Sub-industry

|

Sub-industry |

2020 |

2021 |

2022 |

Mid-2023 |

|

sports footwear and apparel industry |

-1.69% |

18.26% |

11.52% |

14.42% |

|

fitness equipment industry |

10.52% |

19.42% |

-24.83% |

-26.00% |

|

Outdoor equipment industry |

-1.30% |

53.17% |

7.52% |

-25.64% |

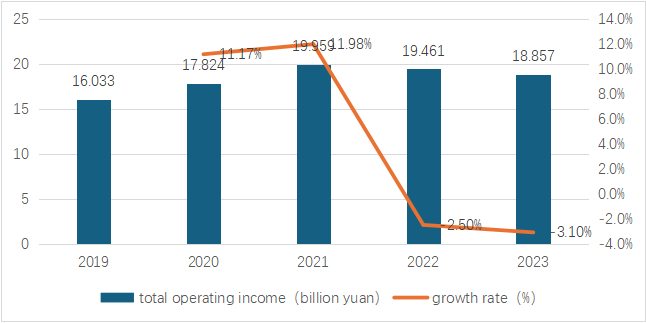

5.1.2 Changes in production scale of sample companies

An analysis of 183 valid samples with complete data among member companies found that in the first two years of the COVID-19 epidemic, the world's overreliance on Chinese supply chains.the total output of companies showed a steady upward trend, from 16.033 billion Yuan in 2019 to 17.824 billion Yuan in 2020, with an increase of 11.17%, and further increased to 19.959 billion Yuan in 2021, with an increase of 11.98%, which is much higher than the growth rate of GDP in the same period (see Figure 4). The output scale has entered a period of adjustment, with a slight decline, but remained stable overall, which the sporting goods industry demonstrated its resilience in 2022 and 2023.

Figure 4 Change of total operating income of sample enterprises

From the perspective of sub-industry (see Table 3), the operating income of the ball games and tennis & badminton sports products, sports equipment and artificial grass industries among member companies generally maintain growth in 2023, with growth rates of 6.57%, 5.94%, and 5.63% respectively. The industries of sports flooring, Sports venue and facilities and construction, and fitness equipment experienced a certain degree of decline.

Table 3 Change In Operating Income Growth Rate by Sub-industry 2020-2023(%)

|

Sub-industry |

2020 |

2021 |

2022 |

2023 |

|

fitness equipment |

23.48 |

11.56 |

-19.05 |

-6.10 |

|

Ball games and tennis & badminton sports products |

8.27 |

10.77 |

10.40 |

6.57 |

|

sports flooring |

-0.10 |

14.53 |

36.03 |

-23.36 |

|

artificial grass |

10.39 |

0.70 |

11.58 |

5.63 |

|

sports equipment |

-0.39 |

12.50 |

3.05 |

5.94 |

|

Sports venues and facilities and construction |

10.81 |

9.23 |

7.12 |

-6.94 |

5.2 Profitability of the sporting goods industry

Among the 40 listed companies examined, a total of 32 companies achieved profits in 2022, and 8 companies suffered losses. The number of profitable companies accounted for 80.00%, which was much higher than the 46.01% profit ratio of A-share companies in the same period. there were 33 companies achieved profits in the first half of 2023, accounting for 82.50%. Some companies have maintained strong profitability, and their gross profit margins have remained high. Such as Biemlfdlkk, Anta Sports, and China Dongxiang, all of which have sales gross margins exceeding 60%.

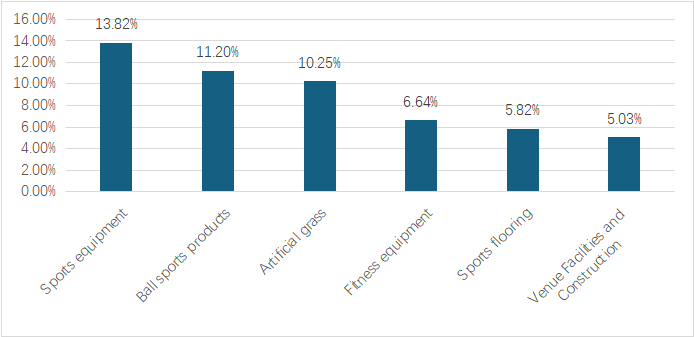

The overall performance of operating among the member companies surveyed in 2023 was deemed satisfactory, with over 90% of companies achieving profitability, and the profit ratio was basically the same as in 2022. To Further examine and compare the profitability of each sub-industry, the operating data of each enterprise in the sub-industry from 2019 to 2023 is summed up and calculate the net profit margin. (seen Figure 5) Profitability of the three industries of sports equipment, sports balls and tennis & badminton sports products, and artificial grass is most outstanding. Among them, the sports equipment industry’s net profit margin of revenue reached 13.82%, ranking first, and sports balls and tennis & badminton and artificial grass industries also demonstrated a net profit margin exceeding 10%. The net profit margin of revenue of the three industries of fitness equipment, sports flooring, sports venues and facilities, and construction exhibited a sustained a reasonable net profit margin.

Figure 5 Net profit margin of revenue for sporting goods 2019-2013, by sub-industry

6 Analysis of the demand for sporting goods market

6.1 Government Procurement of Sporting Goods

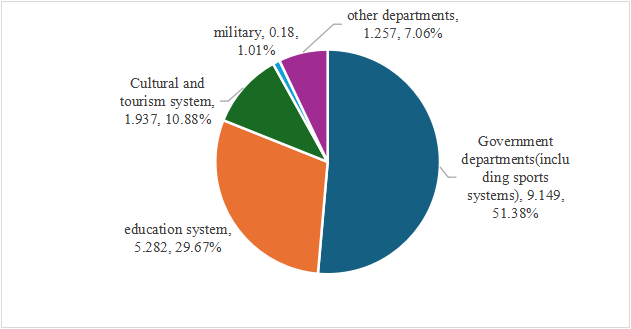

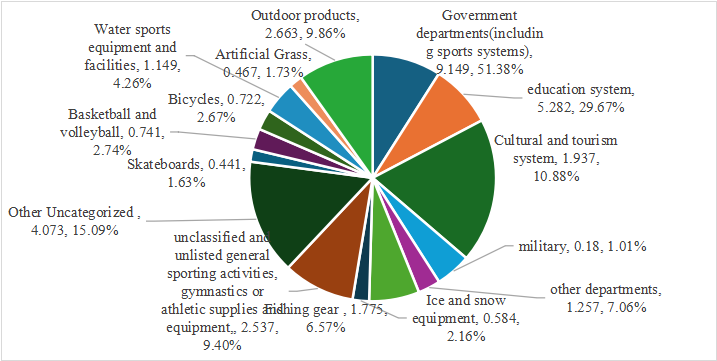

From the sports procurement sector, there were 9,172 sports procurement projects nationwide, with a procurement amount valued at 17.805 billion yuan in 2023. Among them, the procurement projects of government agencies (including sports systems) and education systems were 4109 and 3229 respectively, accounting for 44.80% and 35.20% respectively. In terms of procurement amount, government agencies (including the sports system) and education system were 9.149 billion yuan and 5.282 billion yuan respectively, accounting for 51.38% and 29.67% of the national procurement amount. Cultural and tourism systems also secured a significant portion of the sports procurement, with the respective procurement items and procurement expenditure constituting 12.45% and 10.88% of the total sports procurement. (see Figure 6).

Figure 6 Amount and proportion of sport procurement in China 2023, by sector

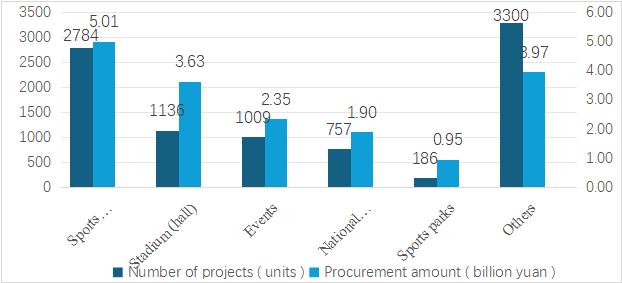

Categorized by the type of procurement. The procurement amount for sports gear and equipment reached 5.005 billion yuan in 2023, accounting for 28.11% of the overall procurement amount, and the procurement amount for sports venues and sports stadium projects was 3.632 billion yuan, accounting for 20.40%. In terms of other projects, the procurement amount for event activities was 2.35 billion yuan, and for national fitness-related and sports parks was 1.9 billion yuan and 953 million yuan respectively. (see Figure 7)

Figure 7 Size of procurement of sports projects in China, by category

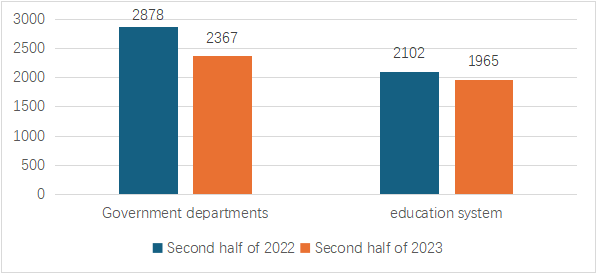

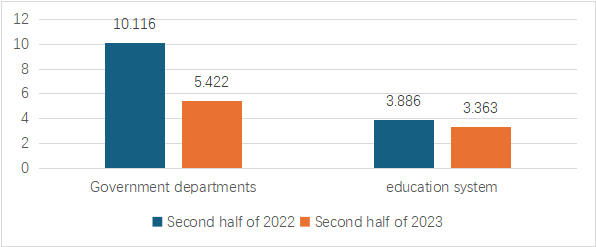

From changes in the procurement scale. In comparison, the scale of sports procurement in China has declined in 2023 compared to the same period last year. For instance, there were a total of 5,338 sports procurement projects nationwide, with a procurement amount valued at 10.493 billion yuan in the second half of the year in 2023. There were 5,734 procurement projects, with a procurement amount valued at 15.803 billion yuan in the same period of 2022. In particular, the number and amount of government sports procurement items have dropped significantly, with the purchase amount falling by 46.85%. The decrease in procurement in the education system was relatively small, with the purchase amount decreasing by 13.46% (see Figure 8).

Figure 8 Number of sports procurement projects nationwide

Figure 9 Value of sports procurement projects nationwide

6.2 Analysis of medium- and long-term demand in the sporting goods market

6.2.1 Adjustment of Sports venues and facilities construction from comprehensive promotion to optimization of structure

China issues National Fitness Plan for 2021-2025 to promote the development of national fitness which is carried out to shore up our weak spots of national fitness facilities. and there will still be a large new market demand in the future. However, the per capita area of sports venues in China has reached the objective set in the “14th Five-Year Plan for Sports Development (2021-2025) " ahead of schedule, which means that the construction of sports venues and facilities is expected to be adjusted from comprehensively increasing construction efforts and increasing the supply of sports venues and facilities to focusing on layout, Optimized structure for balanced development the construction of sports venues and facilities in the future.

6.2.2 Demand triggered by the replacement and scrapping cycle

Excess inventory after years of large-scale construction of sports venues and facilities triggered the demand for replacement and scrap. The Action Plan for Promoting Large-scale Equipment Renewal and Trade-in of Consumer Goods (Guo Fa [2024] No. 7) released recently by The State Council requires the implementation of equipment update actions, trade-in actions for consumer goods, recycling actions, and standard improvement actions. The industries involved in equipment renewal and renovation, urban renewal and renovation of old compounds, and cultural and tourism equipment renewal and upgrade will have a positive impact on the transformation and upgrading of the sporting goods industry and market demand.

6.2.3 Demographic changes affect the medium- and long-term demand for sporting goods

The decline in the birth rate will have an impact on the distribution of educational resources and adjustment of educational resources deeply and will continue to affect the construction of sports venues and facilities in the education system and the demand for sporting goods. According to China’s government sports procurement in 2023, the education system's procurement scale accounts for about 30%. The procurement scale will decline to some degree and gradually enter the stage of "reducing quantity and improving quality" when the number of various types of schools decreases in the future.

7. Analysis of Import and Export of Sporting Goods

Utilizing the import and export commodity codes enacted by the close of 2023, a dataset comprising 77 distinct items (as categorized by the 8-bit code) within the sporting goods sector was procured through a process of categorization and filtration.

Based on The Import and Export Commodity Codes Regulation Act implemented at the end of 2023, 77 small items (8-digit commodity codes) of sporting goods category import and export data were obtained through classification screening.

7.1 Overview of import and export of sporting goods

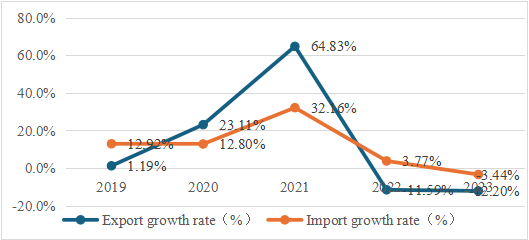

In recent years, there has been a notable fluctuation in the export trends of sporting goods. which is from explosive growth during the COVID-19 epidemic to a significant decline in the post-epidemic period. The export growth rates in 2020 and 2021 have reached 23.11% and 64.83% respectively, and the export scale in 2021 has reached US$35.871 billion, hitting historic highs. (see Table 4 and Figure 9). As the global epidemic recedes, export growth began to adjust in 2022, falling by 11.59%. Sporting goods exports continued to adjust, with exports reaching US$26.651 billion, a 12.20% year-on-year decline in 2023.

Table 4 Value of import and export of sporting goods, China, 2019-2023 (US$ billion)

|

Year |

2018 |

2019 |

2020 |

2021 |

2022 |

2023 |

|

Exports |

16.722 |

16.921 |

20.831 |

34.335 |

30.355 |

26.651 |

|

Imports |

0.913 |

1.031 |

1.163 |

1.537 |

1.595 |

1.54 |

|

Total exports and imports |

17.635 |

17.953 |

21.995 |

35.871 |

31.949 |

28.191 |

Figure 10 Growth Rate of Sporting Goods Imports and Exports, 2019-2023

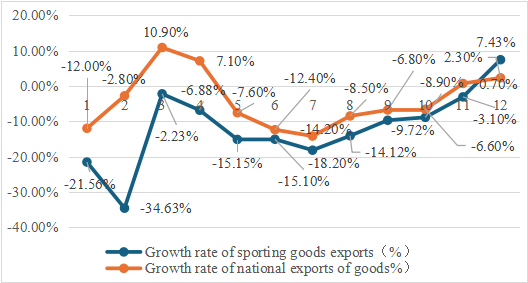

From the annual export performance in 2023, exports fell sharply in the first quarter, followed by a progressive stabilization in the second and third quarters, and then improved in the fourth quarter. The overall results of annual exports look resilient enough. (see Figure 10). Especially in the second half of the year, there was a gradual decline in sporting goods exports, from -18.20% in July to -14.12% in August, and -9.72% in September, steadily rebounding, and achieving positive growth in December, surpassing the national cargo growth rate. The plotted series in Figure 10 shows a golden cross indicating obvious signs of recovery in sporting goods exports and predicting an increase in exports in early 2024.

Figure 11 Growth Rate of Sporting Goods Exports vs. National Goods Exports by Month, 2023

7.2 Commodity structure of sporting goods exports

Among all categories, the export of fitness equipment products was US$5.125 billion, accounting for 19.23% of the total exports, ranking first. The export of outdoor products was US$2.663 billion, that of sportswear was US$2.435 billion, and that of sports footwear was US$2.234 billion, accounting for 9.99%, 9.14%, and 8.38% respectively (see Figure 11), excluding unclassified and unlisted general sports activities, gymnastics or athletic supplies and equipment.

Figure 12 Export Value and Share of Sporting Goods Industry, by segment, China, 2023 (US$ billion)

In 2023, with the overall export of sports goods declining by 12.2%, exports of China's Soccer, Basketball, and Volleyball, fitness equipment, and artificial grass increased against the trend, with growth rates reaching 25.17%, 15.59%, and 9.68% respectively. In addition, some other categories have experienced varying degrees of decline. For example, outdoor products fell by 8.37%, and table tennis badminton, and tennis equipment fell by 7.38%.

7.3 Distribution of Sports Goods Exports of Major Trading Countries

The sporting goods export market in 2023 was that the United States still held its leading position, with the value of goods exports to the United States reaching US$7.934 billion, accounting for 29.77% of total exports. Japan and the United Kingdom ranked second and third respectively, with the value of goods exports US$1.364 billion and US$982 million, accounting for 5.12% and 3.68% respectively. The other top ten exporting countries are the United Kingdom, Australia, Russia, Germany, South Korea, Malaysia, Canada, and the Netherlands. Exports to Europe, America, and Japan the three-traditional major markets declined sharply in 2023, with the United States and Japan falling by 18.92% and 26.47% respectively. The United Kingdom and Germany also experienced significant declines, while Canada and the Netherlands both experienced declines of more than 30%. It was also, significant, that the markets of Russia and Malaysia were against the trend and experienced increasing sharply, with increases reaching 46.71% and 20.96% respectively.

8. Investment and Financing in the Sporting Goods Industry

8.1 Investment and financing of listed companies

A-share listed sporting goods companies primarily secured direct investment through initial public offerings from 2019 to the first half of 2023. There were a total of eight companies going public which are CoCreation Grass, Shuhua Sports, Huali Group, Zhejiang Natural Outdoor Goods, Huasheng Technology, Sportsoul, Jiangsu Kangliyuan, and Yangzhou Jinquan Travelling Goods. raising a total of 7.653 billion yuan. Furthermore, companies such as China Sports Group Industry, Beijing Sanfo Outdoor Products, Qingdao Doublestar, and ST Guirenniao respectively raised financing through non-public offering funds, mixed ownership reform, or debt restructuring. in terms of borrowing financing, 24 companies are raising approximately 20% of the company's total assets through loans during the same period. Companies raise funds through loans, which are relatively flexible and convenient in operation, but an excessively high asset-liability ratio may increase operating risks and pose challenges to corporate profitability.

H- share sporting goods companies mainly raise funds through new loan financing. Among the 16 H-share listed companies, there are 10 H-share sporting goods companies exhibited new revenue in 2023, with a total of 44.067 billion yuan. As far as time series data is concerned, the company's financing decreased sharply from 2019 to 2021 and recovered in 2022. However, the new financing of listed companies decreased sharply in 2023 again, and it is unstable financially after the epidemic.

8.2 OTC Market

From the OTC market, A total of 4 Private Equity Financing deals were announced in the sporting goods companies sector, with a total deal value of 14 million yuan in 2023 (see Figure 12), It's the lowest level since 2014. Investment and Financing in the Sporting Goods Industry have most likely entered a contractionary phase, which could signal the second economic trough of the past ten years. This reflects risk capital maintains a prudent investment attitude towards the sporting goods industry.

Figure 13 Changes in Private Equity Financing for Sporting Goods Companies

9. Key sub-industry in the sporting goods industry

The Sports Footwear and Apparel Industry. The sports footwear and apparel market showed a recovery trend in 2023. Data released by the China Business Industry Research Institute shows that the sports footwear and apparel market reached 492.6 billion yuan in 2023. It is expected that the market size of China’s sports footwear and apparel market will increase to 542.5 billion yuan in 2024.

Fitness equipment industry. According to the " China Fitness Industry Report 2023", the number of fitness clubs and fitness studios in core cities in China has decreased, falling by 8.94% and 7.38% respectively in 2023. However, home fitness was increasing, and the number of people buying fitness equipment was gradually increasing. According to statistics from iiMedia Research, China's fitness equipment market was expected to reach 71.02 billion yuan in 2023, expected to continue to maintain a high growth rate of 12.6% in 2024, reaching 79.96 billion yuan.

Sport Balls Industry. According to the "China Basketball Development Report" released by the Chinese Basketball Association in 2023, the number of basketball population in China has reached approximately 125 million, of which the core basketball participants is approximately 76.1 million, and Sport Balls supplies market has a solid foundation for development. The production of Sport Balls is mainly concentrated in Zhejiang, Jiangsu, Guangdong and other places, and the industrial agglomeration effect is significant.

Sports Flooring Industry. Area of sports field increased from 2.917 billion square meters in 2019 to 4.071 billion square meters by the end of 2023 in China, with an average annual compound growth rate of 8.69%. According to the data released by The Ministry of Education of the People's Republic of China show that the area of sports field at all levels and types of schools’ accounts for 57.40% of the area of sports field nationwide. With the demographic changes caused by the declining birth rate in recent years, the construction scale of school sports field will undergo structural adjustments in the future for a long time, which will affect the demand for sports field construction.

10. Enterprise Prosperity Index of Sporting Goods Industry

All comprehensive prosperity indicators of sporting goods industry in China including Enterprise Prosperity index and Entrepreneur Confidence Index, were in normal confidence intervals in 2023. Enterprise Prosperity Index of the sporting goods industry is 145.6, which was in a relatively prosperous range. In terms of scale, the prosperity index of large and medium-sized enterprises reached 155.3, which was in a relatively strong range; while the prosperity index of small and micro enterprises was 139.6, which was in a relatively prosperous confidence interval. (see Table 5) From the perspective of sub-industry, the prosperity indexes of sports equipment and sports flooring are 172.7 and 158.3 respectively, which were in a relatively strong prosperity range. (see Table 6)

Table 5 Enterprise Prosperity index by Scale

|

By scale |

Enterprise prosperity index |

Interval |

|

overall industry |

145.6 |

comparative prosperity interval |

|

large and medium-sized enterprises |

155.3 |

strong prosperity interval |

|

small and micro-sized enterprises |

139.6 |

comparative prosperity interval |

Table 6 Enterprise prosperity index by sub-industry

|

By sub-industry |

Enterprise prosperity index |

Interval |

|

fitness equipment |

142.7 |

comparative prosperity interval |

|

sports flooring |

158.3 |

strong prosperity interval |

|

sports equipment |

172.7 |

strong prosperity interval |

|

artificial grass |

140.0 |

comparative prosperity interval |

The Entrepreneur Confidence Index of the sporting goods industry in 2023 was 120.8, indicating that entrepreneurs were optimistic about the development of the industry and the macroeconomic environment in the coming year. In terms of scale, The Entrepreneur Confidence Index of large and medium-sized enterprises was 129.3, which was in a relatively confident range; The Entrepreneur Confidence Index of small and micro-sized enterprises was 115.5, which was in a relatively confident range. (see Table 7 & Table 8) Entrepreneurs from large and medium-sized enterprises were more confident about the macroeconomic environment and the development of the entire industry in the coming year than small and micro-sized enterprises. From the perspective of sub-industry, The Entrepreneur Confidence Index of fitness equipment and sports equipment is in a relatively confident range, higher than that of the entire sporting goods industry.

Table 7 Entrepreneur Confidence Index by Scale

|

By scale |

Entrepreneur Confidence Index |

Interval |

|

overall industry |

120.8 |

comparative confident interval |

|

large and medium-sized enterprises |

129.3 |

comparative confident interval |

|

small and micro-sized enterprises |

115.5 |

comparative confident interval |

Table 8 Entrepreneur Confidence Index by Sub-industry

|

By sub-industry |

Entrepreneur Confidence Index |

Interval |

|

fitness equipment |

140.0 |

comparative confident interval |

|

sports flooring |

115.0 |

comparative confident interval |

|

sports equipment |

141.8 |

comparative confident interval |

|

artificial grass |

111.7 |

comparative confident interval |

Individual prosperity index showed that the Expected Order Index of sporting goods industry was 138, the Expected Employment Index was 134.2, and the Expected Fixed Asset Investment Index was 126.6, all of which were in a comparative prosperous range.

From the performance of some sub-industry, the Expected Order Index of fitness equipment, sports flooring, sports equipment and artificial grass are 136.4, 141.7, 145.5 and 150 respectively, which were in a comparative prosperous range, showing that its market judgment of the next year was more optimistic. And the Expected Employment Indexes of the four sub-industry, respectively for 140.9, 150, 145.5 and 150, were also in a comparative prosperous range; the Expected Fixed Asset Investment Indexes of fitness equipment, sports flooring, sports equipment are 122.7, 141.7, 136.4, which were in a comparative prosperous range, and the Expected Fixed Asset Investment Index of artificial grass is 116.7, which was in a relatively prosperous range.( (see Table 9)

Table 9 Individual Prosperity Index by Sub-industry

|

By sub-industry |

the Expected Order Index |

the Expected Employment Index |

the Expected Fixed Asset Investment Indexes |

|||

|

value |

interval |

value |

interval |

value |

interval |

|

|

fitness equipment |

136.4 |

comparative prosperity interval |

140.9 |

comparative prosperity interval |

122.7 |

comparative prosperity interval |

|

sports flooring |

141.7 |

comparative prosperity interval |

150.0 |

comparative prosperity interval |

141.7 |

comparative prosperity interval |

|

sports equipment |

145.5 |

comparative prosperity interval |

145.5 |

comparative prosperity interval |

136.4 |

comparative prosperity interval |

|

artificial grass |

150.0 |

comparative prosperity interval |

150.0 |

comparative prosperity interval |

116.7 |

relatively prosperous interval |

11. Recommendations for the sporting goods industry in China

Firstly, enterprises shift from "scale expansion" to "structural upgrade", focus on quality over quantity, and accelerate technological iteration and quality upgrading. Under the background that the "quantitative gap" of sports venues and facilities has been basically solved, the development strategic positioning with " focusing on quantity " as the core should be changed, the product structure should be optimized, and the development trend of sports consumption should be adapted to personalization, diversification, intelligence, and digitization, shifting from focusing on quantity to pursue high-quality growth, so as to improve the quality and expand the production capacity.

Secondly, for a long time, the traction of rapid expansion of market demand and the driving force of labor cost advantages have worked together to form a joint force for the development of the sporting goods industry. Under this development model, many companies have been positioned in OEM production or low-end product production for a long time, and their market development capabilities and product innovation capabilities are insufficient. At present, the two driving forces are undergoing changes, Enterprises should rethink their development paths, break the inherent development model, pay attention to the improvement of independent innovation ability, and achieve the transformation from "factor-driven" to "innovation-driven".

Thirdly, focus on the adjustment of social structure and economic structure, follow up on changes in market demand in a timely manner, get closer to the market and consumers, and always integrate the service concept throughout the entire value chain activities, through the organic integration of products and services, manufacturers and consumers. Which requires the full participation of all stakeholders and the collaboration and communication of all stakeholders in the production and manufacturing process to complete a value creation process that is to oriented the personalized needs of consumers.

Fourthly, strengthen innovative research and development capabilities, rely on technological innovation, crafting a Winning Quality Strategy, and focus on brand building, strengthen brand building and shaping to achieve high-quality development, and enhance brand competitiveness.

Fifthly, with the overall decline of traditional developed export markets, there are certain development opportunities in emerging markets, and ASEAN countries and Latin American markets are expected to become a new era of export growth. At the same time, emerging market countries, with their labor force and raw material price advantages and good investment environment, are triggering the restructuring of the global sporting goods manufacturing industry chain, which is also an important change that companies must pay attention to.

Copyright ©2013-2024 CHINA SPORTING GOODS FEDERATION, All Rights Reserved ( 京ICP备05083596号-1 )